If you have any questions, please send an email to contact@acon3d.com.

Notice

22.04.06 Limited tax rate update for Indonesia residents

| 印度尼西亚居民的有限税率更新 | インドネシア在住者のための制限税率アップデート

22.03.29 Now you can upload your Payment Documents on your Creator account!

| 现在您可以将文档上传到您的创作者帐户!| もう私の創作者アカウントで書類を提出することができます!

Files

※ If your country of residence is not included below, please check the ‘Country Information’ section to fill out the form.

※ Are you a company? For corporate use, please download the documentation below.

※ If your country of residence is not included, please contact us via contact@acon3d.com.

※ For countries marked as 'N/A', the application is not required as there are no relevant tax treaties with South Korea. Please submit only your self-verification document including your nationality.

FAQ

Do I have to submit the form every time?

我必须每次都提交申请吗?| 毎回、申請書を提出するんですか?

What happens if I do not submit the form?

如果我不提交申请会怎样? | 申込書を提出しないとどうなりますか ?

How do I fill out the form?

我如何填写申请表?| 申込書はどうやって作成しますか ?

How do I submit the form?

我如何提交我的申请? | 申込書はどうやって提出しますか ?

What should I do if my current address does not match my nationality?

如果我当前的地址与我的国籍不同怎么办?| 現在の住所が国籍と異なる場合はどうなりますか?

I do not have a taxpayer number. What should I do?

我没有纳税人号码。| 納税者番号を持っていません。

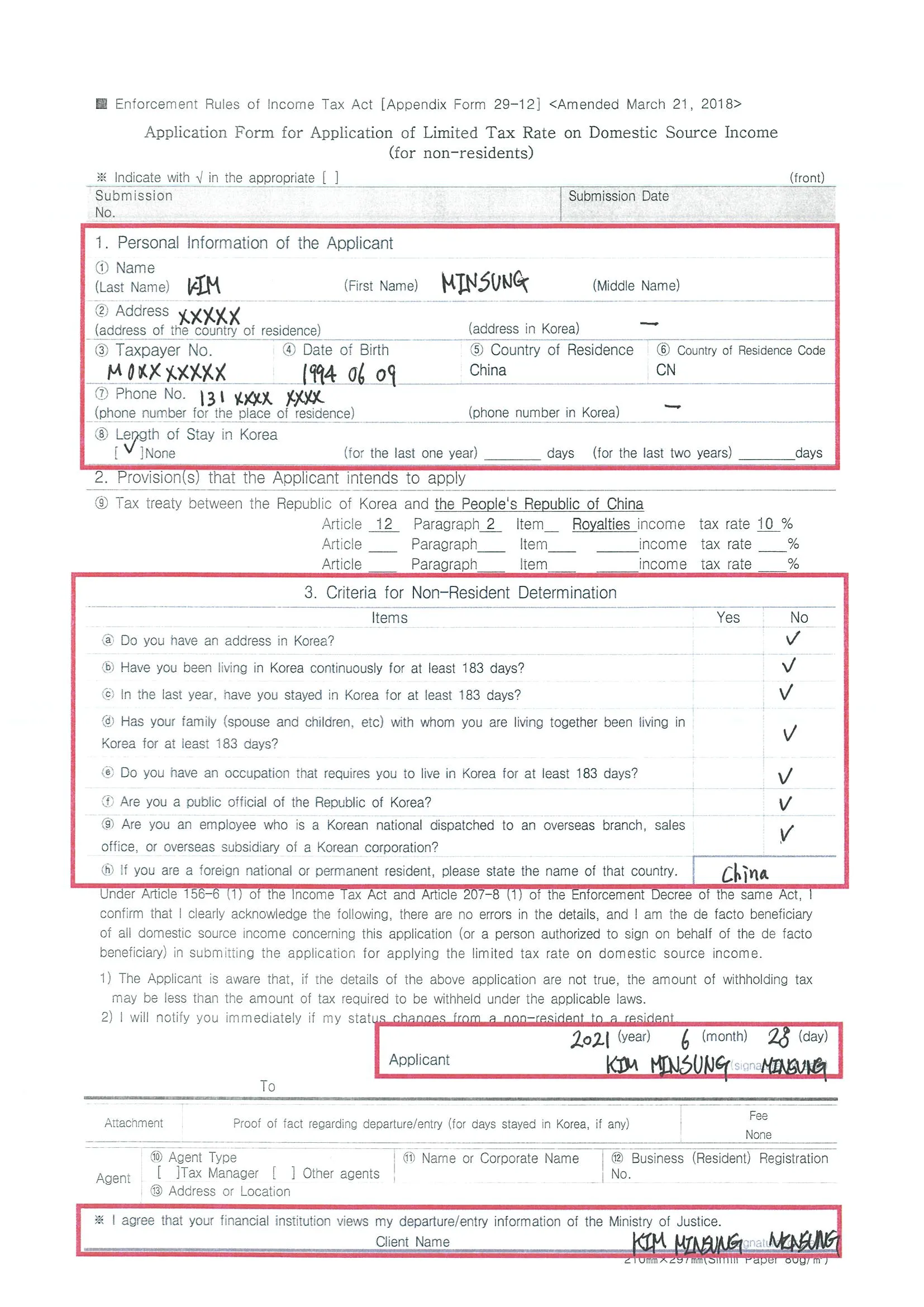

Example

Must Fill In

1.

Personal Information of the Applicant | 申请人信息

(1) Name | 姓名

: Please write in English, in the order of your last, first, and middle name.

: 请按照姓氏和名字的顺序用英文书写。

•

(2) Address | 地址

: Please write in the order of address number → country.

: 从详细地址到国家的顺序写下来。

•

(3) Taxpayer No. | 纳税人编号

: Please write your passport number, national ID, or TIN - identical to your self-verification method.

: 写下您的护照号码、国民身份证号码或纳税人识别号码 (TIN)。

•

(4) Date of Birth | 出生日期

: YYYY.MM.DD

•

(5) Country of Residence | 居住国家

: Based on your current legal address. If your address does not match your nationality, please contact us.

: 基于当前的合法居住地。如果您的国籍和法定地址不同,请联系我们。与您的自我验证方法相同。

•

(6) Country of Residence Code | 居住国家代码

: Please check the Country Information table below.

: 请查看以下国家特定信息表。

•

(7) Phone No. | 电话号码

: Please add your country code in front.

: 请在号码前加上国家代码。

•

(8) Length of Stay in Korea | 在韩国的居住时间

: You may simply check 'None'.

: 只需勾选“None(无)”

2.

Provision(s) that the Applicant intends to apply | 海外预扣税有限税率规则

•

Tax treaty between the Republic of Korea and (your country) | 贵国与韩国之间的税收协定

: Please check the table below.

: 请查看以下国家特定信息表。

3.

Criteria for Non-Resident Determination | 韩国检查非居民身份

Questions a-g

: If you do not live in Korea, please check 'No.'

: 如果您不住在韩国,请勾选“No(否)”。

•

(h) If you are a foreign national or permanent resident, please state the name of that country.

| 如果您是外国公民或永久居民,请说明该国家/地区的名称。

: Write your country.

: 请写出你的国家。

4.

Date and Applicant Signature | 日期和签名

Date | 日期

•

Applicant | 申请人

: Please write your English name and signature.

: 用英文写下您的姓名和签名。

5.

Client Name and Signature | 签名

: Please write your English name and signature.

: 用英文写下您的姓名和签名。